Understanding The Different Types Of Bankruptcy: A Guide By Tulsa Bankruptcy Attorneys

Table of ContentsBankruptcy Attorney Tulsa: Offering Compassionate And Skilled Legal HelpTulsa, Ok Bankruptcy Attorney: Debunking Common Bankruptcy MisconceptionsWhat To Expect After Filing Bankruptcy: Tips From Tulsa Bankruptcy AttorneysTulsa Bankruptcy Lawyer: How To Deal With Car Loan Debt In Bankruptcy

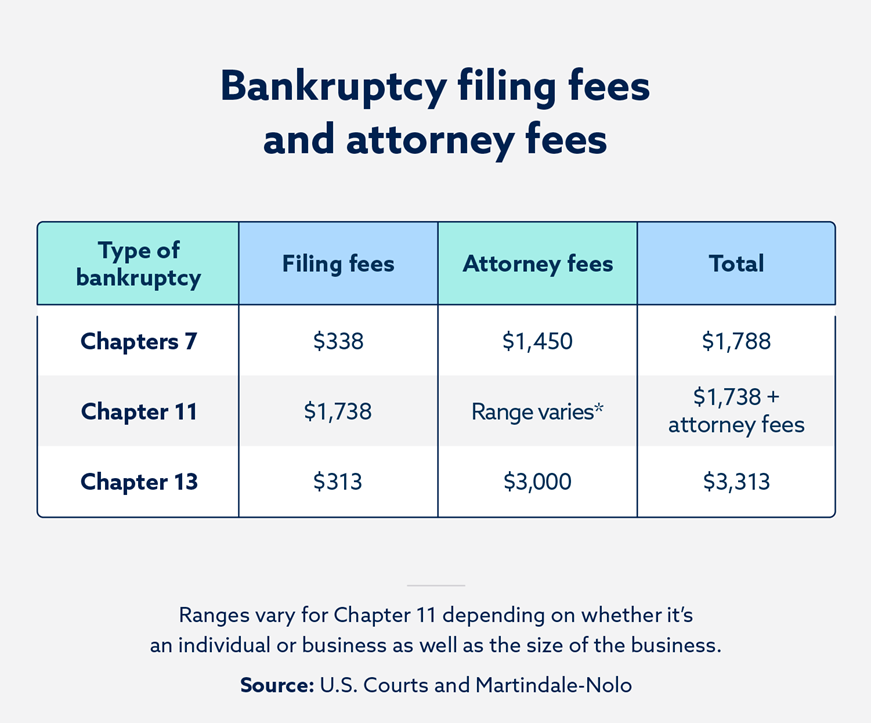

It can harm your credit history for anywhere from 7-10 years as well as be an obstacle towards obtaining safety and security clearances. Nonetheless, if you can't settle your issues in much less than 5 years, insolvency is a practical alternative. Legal representative charges for bankruptcy differ depending upon which develop you pick, how complicated your instance is and where you are geographically. Tulsa OK bankruptcy attorney.Various other bankruptcy prices consist of a declaring fee ($338 for Chapter 7; $313 for Phase 13); and charges for credit report therapy and also monetary management programs, which both cost from $10 to $100.

You do not always require an attorney when submitting individual bankruptcy by yourself or "pro se," the term for representing on your own. If the instance is straightforward sufficient, you can declare personal bankruptcy without aid. But lots of people take advantage of depiction. This short article discusses: when Chapter 7 is as well made complex to manage yourself why working with a Chapter 13 attorney is constantly important, as well as if you represent yourself, how a personal bankruptcy petition preparer can assist.

The general regulation is the simpler your bankruptcy, the far better your opportunities are of finishing it by yourself and obtaining a personal bankruptcy discharge, the order erasing debt. Your situation is most likely easy sufficient to handle without an attorney if: However, also straightforward Phase 7 situations need job. Plan on submitting considerable documentation, gathering economic paperwork, researching insolvency as well as exception regulations, and following neighborhood guidelines and also treatments.

5 Tips For Choosing A Reliable Tulsa Bankruptcy Attorney

Here are two situations that always call for representation., you'll likely want an attorney.

Filers do not have an automatic right to disregard a Chapter 7 case. If you slip up, the insolvency court can throw away your instance or sell assets you thought you can keep. You can also encounter a personal bankruptcy lawsuit to establish whether a financial obligation should not be discharged. If you shed, you'll be stuck paying the financial obligation after personal bankruptcy.

Filers do not have an automatic right to disregard a Chapter 7 case. If you slip up, the insolvency court can throw away your instance or sell assets you thought you can keep. You can also encounter a personal bankruptcy lawsuit to establish whether a financial obligation should not be discharged. If you shed, you'll be stuck paying the financial obligation after personal bankruptcy. You might intend to file Chapter 13 web to catch up on home mortgage financial obligations so you can keep your home. Or you visit homepage might intend to do away with your second home mortgage, "cram down" or minimize an auto loan, or repay a financial debt that won't go away in personal bankruptcy over time, such as back taxes or assistance debts.

You might intend to file Chapter 13 web to catch up on home mortgage financial obligations so you can keep your home. Or you visit homepage might intend to do away with your second home mortgage, "cram down" or minimize an auto loan, or repay a financial debt that won't go away in personal bankruptcy over time, such as back taxes or assistance debts.In numerous situations, a personal bankruptcy lawyer can promptly recognize problems you could not identify. Some individuals data for personal bankruptcy because they do not recognize their options.

Top 10 Tulsa Bankruptcy Attorneys: A Comprehensive Guide

For most customers, the logical selections are Phase 7 as well as Chapter 13 insolvency. Tulsa bankruptcy lawyer. Phase 7 can be the means to go if you have low earnings as well as no assets.

Here are common issues insolvency lawyers can prevent. Personal bankruptcy is form-driven. Numerous self-represented bankruptcy borrowers don't file all of the required personal bankruptcy papers, and their instance obtains dismissed.

If you stand to lose useful residential property like your house, car, or other property you care around, a lawyer might be well worth the cash.

Not all personal bankruptcy cases proceed efficiently, and other, a lot more challenging problems can arise. Lots of self-represented filers: don't understand the significance of activities and opponent activities can not appropriately protect versus an action looking for to refute discharge, and have a tough time abiding with complicated personal bankruptcy treatments.

When To Consider A Tulsa Bankruptcy Attorney For Your Financial Situation

Or another thing might emerge. The lower line is that a lawyer is necessary when you find on your own on the receiving end of an activity or claim. If you make a decision to file for insolvency by yourself, figure out what services are offered in your area for pro se filers.

, from sales brochures describing affordable or cost-free services to detailed details about personal bankruptcy. Look for a personal bankruptcy book that highlights scenarios needing an attorney.

You need to accurately submit many kinds, study the legislation, and also attend hearings. If you understand personal bankruptcy regulation however would like aid completing the kinds (the average bankruptcy petition is about 50 pages long), you may take into consideration working with a bankruptcy application preparer. A personal bankruptcy request preparer is anyone or company, apart from a lawyer or a person who benefits a lawyer, that bills a fee to prepare bankruptcy documents.

Because personal bankruptcy application preparers are not attorneys, they can't give legal guidance or represent you in insolvency court. Particularly, they can not: tell you which type of personal bankruptcy to submit inform you not to provide specific financial debts tell you not to note certain assets, or inform you what building to excluded.

Because personal bankruptcy application preparers are not attorneys, they can't give legal guidance or represent you in insolvency court. Particularly, they can not: tell you which type of personal bankruptcy to submit inform you not to provide specific financial debts tell you not to note certain assets, or inform you what building to excluded.